What Does It Mean to Provide Federal Income Tax Return for I-864 and W-2s, 1099s and Form 2555

The U.S. regime wants to see evidence that the spouse seeking a marriage-based greenish card will be financially secure once in the United States, and isn't likely to rely on public benefits in the future.

In this guide you volition acquire:

- Who needs to provide tax documents

- Which type of tax documents practice y'all demand to include?

- What a sample tax render transcript looks like

- How many years of tax returns are required

- What if you lot filed joint taxes?

- What if you or your spouse didn't file taxes?

Not sure if you qualify for a marriage-based dark-green carte du jour?

Kickoff by checking your eligibility.

Who Needs to Provide Tax Documents?

The sponsoring spouse needs to provide U.S. federal tax returns every bit office of Form I-864 (officially called the "Affidavit of Support"), a signed document to hope financial support of the spouse seeking a greenish carte du jour. If the sponsoring spouse and their household are unable to see the minimum fiscal requirements of a family-based dark-green menu, then a joint sponsor will besides need to include their tax returns. Acquire more almost the additional documents needed for articulation filers here.

If the sponsoring spouse didn't file taxes in the United States, they will need to provide an exemption letter. Learn more than here.

The spouse seeking a greenish card does not need to include any tax information

Boundless can guide you through the unabridged wedlock greenish menu application procedure. Read more nigh what you get with Boundless, or become started today.

Which Types of Tax Documents Practise I Need to Include?

The types of tax documents needed depends on the course.

Financial Support Form (I-864)

The sponsoring spouse (and financial co-sponsor if whatever) will demand to provide the following tax testify as part of Form I-864:

| Certificate Blazon | Examples of Acceptable Documents | Who Needs It? |

| Proof of power to financially support the spouse seeking a dark-green bill of fare |

| Sponsoring spouse and financial co-sponsor (if whatever) |

With Boundless, yous become the peace of mind that comes with having an independent immigration attorney who answers your confidential questions and reviews your entire green card awarding — for no additional fee. Ready to kickoff? Acquire more about what yous go with Dizzying, or check your eligibility at present.

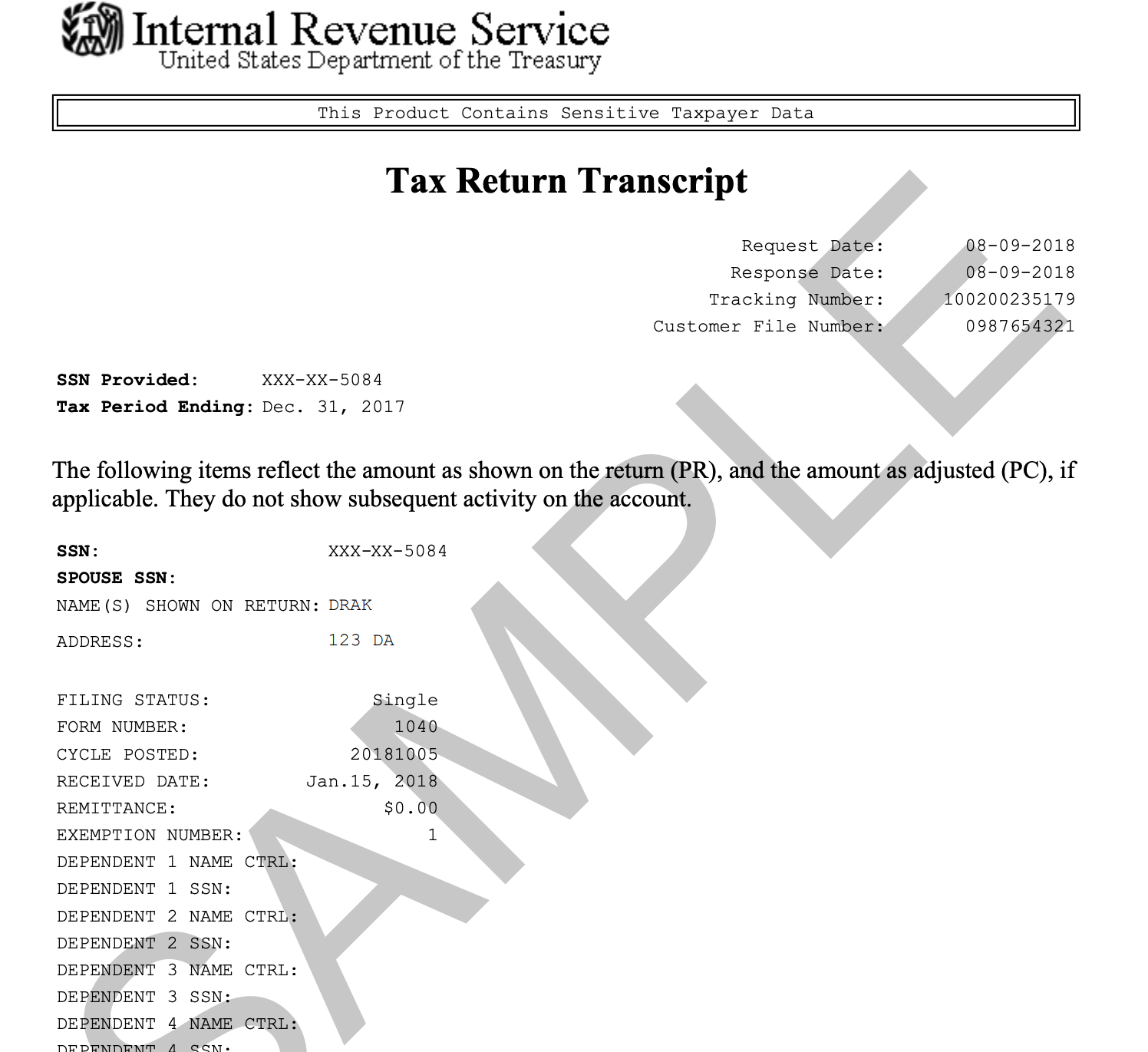

What Does a Taxation Render Transcript Wait Like?

A federal taxation return transcript is a document that shows a summary of your tax return information. The sponsor can request their transcripts from the Internal Acquirement Service (IRS) website for the most recent 3 years they filed taxes.

What should I do if I can't access my Revenue enhancement Return Transcript from the IRS website?

If you tin't access your tax return transcript for a particular filing twelvemonth, y'all instead demand to provide a signed affidavit (written statement) explaining why you're unable to obtain the transcript and that you lot will keep to try to obtain information technology to bring to your green card interview. You'll too need to provide a screenshot of the IRS website showing that your transcript is inaccessible through the IRS "Get Transcript" tool.

The best fashion to ensure your green menu application doesn't get delayed is to file all your paperwork correctly the first time effectually. With Boundless, a dedicated team member will aid you lot steer clear of common mistakes and brand certain your forms and documents are ready for chaser review Learn more, or find out if you're eligible for a green card.

How Many Years of Tax Returns Are Required?

For Course I-864, the U.S government requires proof of tax filing for the most contempo filing year (typically the previous calendar yr). Annotation that the the sponsor (and co-sponsor if whatsoever) has the option to provide taxation filings from the by 3 years.

Boundless stays with you until the green carte du jour finish line, helping you keep on elevation of interview preparation, follow-on forms, and every other important milestone along your immigration journey. Learn more, or check your eligibility for gratis.

What If You Filed Articulation Taxes?

If the couple filed articulation taxes, they will need to provide their federal revenue enhancement render transcript and all supporting documents (including the Westward-ii, 1099, or strange income statements and schedules). This requirement applies to Form I-864.

Do you have confidential questions about how your state of affairs might bear on your green card application? With Boundless, yous get an independent immigration attorney who can assistance you lot empathise your options. Find out more than nearly what yous get with Boundless, or check your eligibility at present.

What If the Sponsor Didn't File Taxes?

If the sponsoring spouse (or joint sponsor if applicative) didn't file any taxes in the previous twelvemonth, they volition need to provide an exemption letter as part of Grade I-864 explaining why they didn't file taxes. The letter should explain that the sponsor's income was below the minimum income required to file in the previous years or years, and therefore they did not file a federal tax render for those years.

Wherever you are in the world, Dizzying mails to your doorstep your complete filing package — including the forms you'll need to work, travel, and ultimately obtain your marriage-based green bill of fare. Learn how Boundless tin help you lot, or check your eligibility today.

Source: https://www.boundless.com/immigration-resources/tax-documents-marriage-green-card-application/

Post a Comment for "What Does It Mean to Provide Federal Income Tax Return for I-864 and W-2s, 1099s and Form 2555"